Airside

The Crotty Airside Insurance facility is designed to cover a broad range of airside operations, conducted by companies and individuals whose primary base is not at the airport.

Bonds

Bond insurance is a type of insurance policy that a bond issuer purchases that guarantees the repayment of the principal and all associated interest payments to the bondholders in the event of default.

Cyber Insurance

Data is a valuable asset. We’ve all read about high profile data security breaches or “cyber attacks” in recent times. But any company that stores client information and data or conducts business online can be vulnerable to a costly cyber attack.

Directors and Officers

Directors and Officers insurance (D&O) offers cover to protect individuals when they are held personally liable for their actions during their tenure as a director, officer or decision maker of a company.

Environmental Liability

Environmental damage can lead to serious consequences for the individual or company that caused these damages and so this is why it is important to have Environmental Liability insurance, to help protect against these risks.

Heritage Property

Crotty Insurance has a specialised Broking Division providing insurance for heritage properties – we will lead you through insurance pitfalls providing you with peace of mind

Jewellers Block

Crotty Insurances have a specialised Jewellers Block Division and have access to a leading Specialist UK Lloyds Facility to provide a comprehensive Jewellers Block Insurance Package to Irish Jewellers Industry.

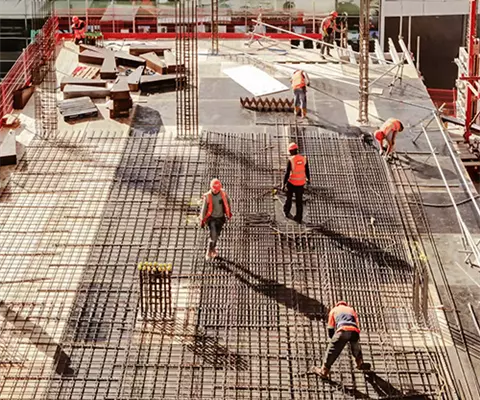

Latent Defect

Latent Defect insurance provides cover against the costs of defects that occur after a structure or a building has been constructed.

Motor Fleet Insurance

At Crotty Insurance, we provide a comprehensive Motor Fleet Insurance service for companies with a minimum of 5 or more vehicles.

Product Recall/Guarantee

Product recall is a specialist form of insurance. Cover is usually purchased by manufacturers and distributors of goods to help protect them against the costs of their product causing bodily injury or damage, due to an unintentional error, after they have been consumed or used as intended.

Title & Planning Risk

A Tittle and Planning Risk Insurance policy can offer protection for costs involved in rectifying both Known and Unknown Title defects. It can be arranged either for a Single Asset, or for a Portfolio of Assets.